About Hargraves

The financial services of Hargraves was established by Joshua Hargrave and has been serving the people of Yarrawonga and District for over 120 years.

Hargraves Secured Investments raises funds from investors by issuing notes, and generates income on those funds primarily by lending to individuals and companies, with security provided by mortgages over real estate. We offer efficient service to investors and borrowers, and have enjoyed steady growth and profitability.

A Long and Proud History

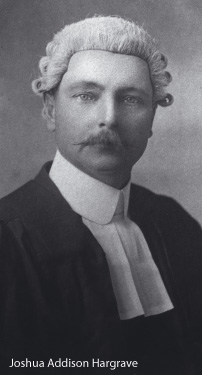

Our history traces back to Joshua Hargrave, who commenced a legal practice in Yarrawonga in 1896.

Joshua and his wife Ada quickly established a sound legal firm, which their children Jessie Hargrave and William Hargrave eventually took over, continuing the Hargrave name through to 1974.

During Joshua’s tenure he saw the need to match those in the community with surplus funds for investment, to business people who needed to borrow. He developed these loans with the concept of the borrower providing first mortgage security over their land. This tradition continues with Hargraves Secured Investments Limited today.

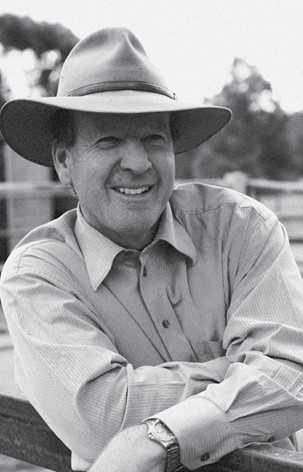

The modern company took shape in 1999, when John Gorman (our current Managing Director) registered the mortgage practice with the Australian and Securities Investment Commission (ASIC), and commenced operating under a Trust Deed setting out the rules upon which we operate. From the early days Mr Gorman has seen the corporation grow through to today with a total of over $110,000,000 (30th June, 2022) in assets.

The Company issues a Prospectus under the Corporations Act 2001 and holds Australian Financial Services Licence No. 241230 authorising the Company to deal in notes of the Company, and has appointed MSC as the Trustee for note holders. The important role of the trustee is described below…

The trustee’s duty under the trust deed and the Corporations Act is to ‘exercise reasonable diligence’ in monitoring the issuer’s ability to repay the notes (e.g. its financial position and performance).

ASIC Regulatory Guide 69 Debentures and notes: Improving disclosure to retail investors